Evelyn Hernandez and Maria da Graça Prado

What is climate finance?

Climate finance refers to financial resources dedicated to climate mitigation and adaptation efforts. Mitigation focuses on reducing greenhouse gas emissions, while adaptation involves measures to decrease vulnerability to climate impacts and enhance the resilience of systems and assets.

A distinctive feature of climate finance is that the resources come from international commitments made by high income countries in the context of climate agreements, such as those established at the United Nations Conferences on Climate Change.

Research shows that despite contributing less to climate emissions than high income countries, the Global South are disproportionately impacted by climate change.

These resources are then accessed by accredited implementing entities, typically multilateral and bilateral development banks, who are responsible for channelling the funds to selected projects.

This financial structure is designed to manage and oversee the flow of climate funds. Accredited implementing entities play a crucial role in this process by allocating resources to projects combating climate change.

Why is climate finance in infrastructure so relevant?

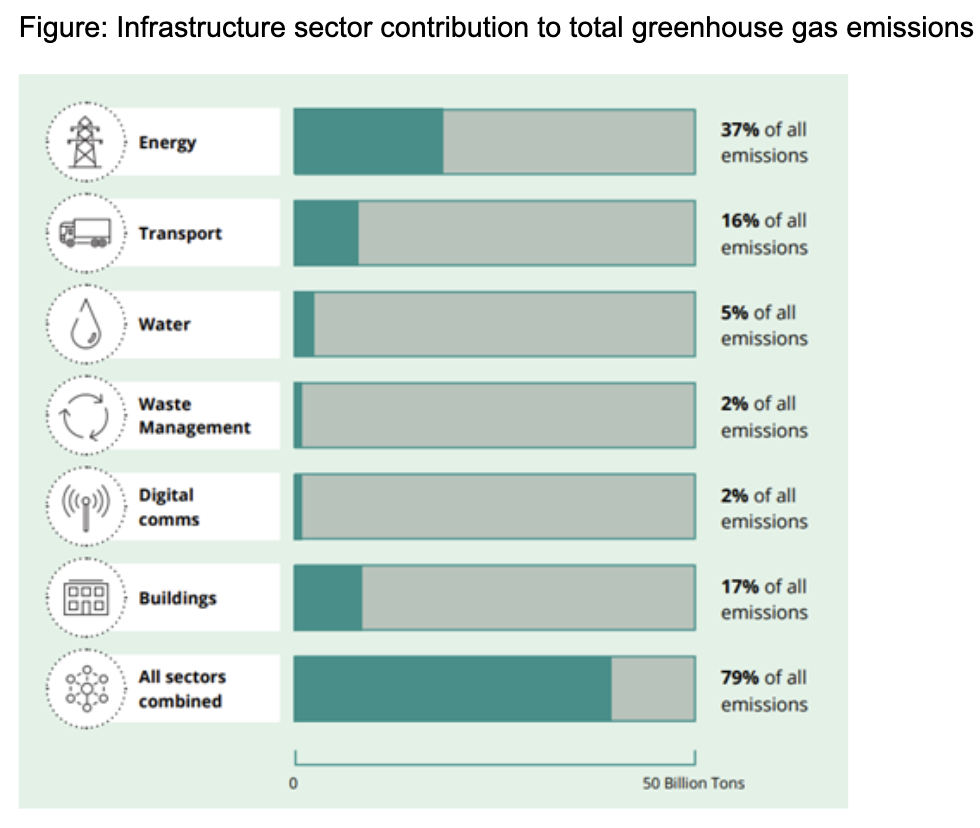

The infrastructure sector is responsible for 79% of global greenhouse gas emissions, with the energy and transport sectors being major contributors. To mitigate climate change effectively, it is essential for the infrastructure sector to significantly reduce its carbon footprint.

Two additional aspects should be considered. Infrastructure systems are highly vulnerable to climate impacts. Therefore, building infrastructure resilience is key to keep critical services operational during and after climate shocks. There is also an urgent demand for new infrastructure that is adapted and designed to operate in line with changing climate conditions. Effectively protecting economies and communities against climate disruptions requires investing in new and existing infrastructure.

The need of transparency in infrastructure climate finance investments

Transparency and anti-corruption are key aspects of our work, and crucial in climate finance investments for several reasons. Infrastructure is a highly complex sector with significant corruption risks. Transparency is a vital governance element to ensure that infrastructure climate projects align with urgent needs and deliver the expected social returns.

There are also currently substantial challenges in tracking down the flow of climate finance throughout the financial structure applied. Investigations have revealed that some investments may have been directed to projects that exacerbate the climate crisis. Data gaps make it difficult to monitor compliance with climate commitments and ensure that funds are used effectively and for their intended purposes.

Estimates from the Climate Policy Initiative calculate that $4.3 trillion is needed to combat the climate crisis by 2030. The scale of investments is unprecedented, and transparency is critical to monitor and verify that climate finance is being used to support projects that genuinely contribute to climate mitigation and adaptation goals.

How we are contributing to improving transparency in climate finance

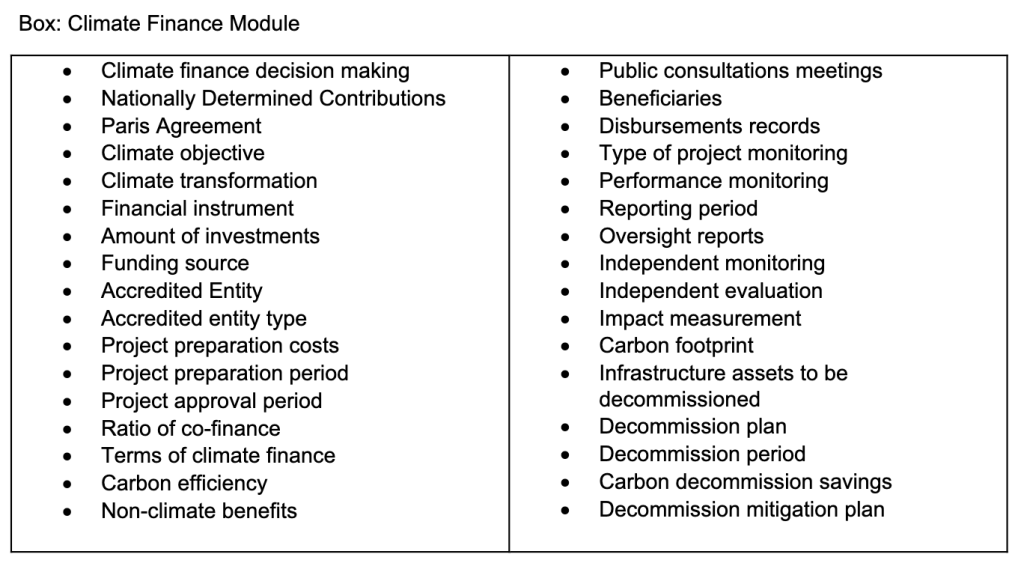

In collaboration with GIZ, we have developed a new climate finance dataset to enhance transparency in climate investment for infrastructure. The module includes 33 data points to be published proactively by procuring entities implementing projects receiving this type of funding.

The data points cover the entire project cycle and can be categorised in three key areas.

- First, detailed information on the financing conditions and the financial structure applied. This includes data points related to the amount of investment, the financial instrument utilized, the terms of climate finance such as interest rates and penalties, the accredited entity responsible for the fund allocation, and any pertinent co-financing ratios.

- The second group is about the intended climate transformation of the project. This includes the project’s alignment with climate objectives, the Paris Agreement, and Nationally Determined Contributions (NDCs). It also covers the project’s carbon efficiency, expected impact, anticipated systemic transformation, and the vulnerable populations that will benefit from the project.

- The third area focuses on accountability-related data points. This includes information on the climate finance decision-making process, public consultations and social engagements conducted, and mechanisms for monitoring and evaluating the project’s outcomes and results.

The data points are formulated to avoid blank statements by requesting procuring entities to provide information as well as submit supporting documentation. This approach helps bring objectivity to the publication of data and to mitigate the risk of greenwashing.

The climate finance module can be adopted alongside sustainability modules developed by CoST and key partners such as the Open Contracting Partnership, the World Bank, and Open Data Services. For the climate finance module, CoST is finalizing a disclosure platform prototype where practical examples of project data will be published to demonstrate how climate finance datasets look in practice.

Conclusion

It is crucial to recognize the urgency of our climate situation. We have moved beyond the era of global warming to what is now described as an era of climate boiling. To ensure that climate finance effectively reaches those who need it most, benefiting the most vulnerable populations, reducing carbon emissions, and building resilience, greater transparency around these investments is essential. With this new climate finance dataset, CoST and GIZ are helping to standardize climate finance information related to infrastructure projects. Detailed guidance explaining CoST new data modules will soon be available on the CoST website.